The largest steel producers in Europe source coking coal from Mozambique where mining companies have displaced thousands of people in order to make way for their large-scale projects. The investigation ‘Broken Promises’ documents how international mining corporations knowingly, and with the approval of the government of Mozambique, have resettled local communities to remote areas with limited access to jobs, food and water. When asked about their supply chain most steel companies claim confidentiality.

Strategically placed on the South Eastern coastline of Africa with ports opening the country to the sea lanes of the Indian Ocean, and with an underground full of largely untapped coal resources, Mozambique is today the world’s fifth largest exporter of coking coal, with approximately 4 million tonnes leaving the Port of Beira every year, some of it headed to feed a growing European market. According to Euracoal, the European demand for coal is increasing, mainly lead by Germany and the UK, and in 2013 European countries imported a total of 40,9 million tons of coking coal.

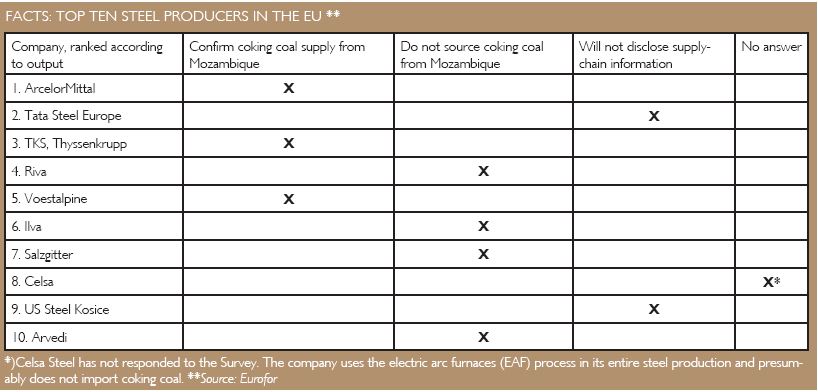

Results from a Danwatch survey sent to the ten largest steel producers in Europe, combined with research into company documents, show that ArcelorMittal, Tata Steel Europe, TKS ThyssenKrupp, and Voestalpine source coking coal from Mozambique. Danwatch has asked all ten companies to disclose their suppliers and to identify which mines they source from.

According to national news agency Bloomberg, Tata Steel is entitled to 40 percent of the outcome from the Benga mine. On the 18th of May 2012 the company’s main director H.M. Nerurkar announced that Tata Steel Europe would receive its first supplies from the mine that month – approximately 800.000 tons, equivalent to 10 percent of is entire coal

requirements, Bloomberg reported on May 22nd 2012.

The Slovaki steel company U. S. Steel Košice, ranking as number 9 on the Eurofer top ten list, has declined to answer the survey.

“I can confirm that we do not provide information about our business partners, suppliers or customers and that we do not want to participate in the survey,” Ján Baĉa, the company’s spokesperson writes in an e-mail to Danwatch. He has since declined to participate in an interview.

The internationally recognized guidelines for corporate responsibility, the OECD Guidelines for Multinational Enterprises and the UN Guiding Principles for Businesses and Human Rights, set clear standards for responsible supply chains.

According to OECD, companies should practice due diligence by investigating third party partners for potential abuse of human rights; set forward standards for corporate behaviour and: “Seek ways to prevent or mitigate adverse human rights impacts that are directly linked to their business operations, products or services by a business relationship, even if they do not contribute to those impacts.”

This investigation shows that the largest steel producers in Europe source coking coal from Mozambique, where mining companies have displaced thousands of people, and in the cases of Mualadzi and Cateme, deprived communities of their livelihoods and limited their access to food and water.

Voestalpine and Tata Steel Europe inform Danwatch that they source coking coal from Mozambique, but they do not wish to disclose the size of their import or from which mines. Voestalpine has declined to answer any further questions, and Tata Steel Europe has declined to answer whether it sources from the Benga mine, of which its parent, Indian Tata Steel, owns 35 percent.

Three of the top-ten steel producers in this investigation can be linked directly to these resettlements through their supply chain.

ArcelorMittal, Tata Steel Europe and ThyssenKrupp have declined to answer any questions directly related to the situation in Cateme and Mualadzi. But in their general statements to Danwatch they refer to both international guidelines and company policies, stressing responsible sourcing and supply chain oversight as a common priority.

The UN Guiding Principles for business and Human Rights establish that while states have the responsibility to protect human rights, companies have the responsibility to respect them. To meet that responsibility companies should have

“(a) A policy commitment to meet their responsibility to respect human rights; (b) A human rights due diligence process to identify, prevent, mitigate and account for how they address their impacts on human rights; c) Processes to enable the remediation of any adverse human rights impacts they cause or to which they contribute.”

Neither Tata Steel Europe, Voestalpine nor ArcelorMittal refer to international guidelines in their answers to Danwatch, ThyssenKrupp however states, that the company expects all its suppliers to comply with with the principles of the United Nations Global Compact, and that the company carries out sustainability audits at individual suppliers.

“The suppliers are selected on the basis of a systematic assessment of risks, in particular country-related risks. This also includes our raw material suppliers.”

Since Danwatch received the statement from Thyssenkrupp, the company has been presented with the findings in this investigation. Thyssenkrupp has declined to comment on the conditions in Cateme and Mualadzi and refer to their general statement, where the final paragraph reads:

“Should a supplier demonstrably fail to meet the standards of the ThyssenKrupp Supplier Code of Conduct or fail to target and implement improvement measures, this can ultimately lead to termination of the business relationship.”

All company statements can be found in full, in Annex 1.

The Chipanga mine, located in the Province of Tete is owned by Brazilian miner Vale. It has a total capacity of 11 million metric tons per year, Only one company, German ThyssenKrupp has informed Danwatch about its supply chain, listing Vale’s Chipanga mine and Rio Tinto’s Benga mine (now ICVL, red.) as their suppliers in Mozambique. However, company reports from the largest steel producer in Europe, ArcelorMittal,

confirm that the multinational company started sourcing from the same mines by 2012.

“In 2012 and 2013, ArcelorMittal further diversified its supply portfolio by adding new supply sources from emerging mines in Mozambique and Russia,” a paragraph reads in the 2013 Annual Report for the United States Securities and Exchange Commision, and in the company’s 2014 Annual Report, Vale and Rio Tinto in Mozambique are listed as

some of ArcelorMittal’s “principal coal suppliers” .

The mine is located in the Tete province of Mozambique, and is part of the Benga Coal Project, initially owned by Tata Steel and Australian concern Riversdale Mining. In November 2007, Tata Steel purchased a 35 percent stake in the project. In April 2011, British-Australian Mining Company, Rio Tinto, took over Riversdale Mining Limited, and its 65 percent share in the Benga Coal Project. In 2014, Rio Tinto sold its shares to the Indian steel and mining company ICVL. Around 35 percent of the mine’s output is coking coal, 10 percent thermal coal, and the remaining 55 percent is waste. From 2010-2014, Riversdale Mining Limited, Rio Tinto and Tata Steel moved 736 families to the Mualadzi

resettlement.