In the creation of this article, we have made use of the Pension Machine. Developed by Danwatch.

Since October last year, Denmark’s third largest pension fund has made a remarkable decision.

The pension fund, which is jointly owned by the trade union 3F and the Confederation of Danish Industry, has welcomed new fossil fuel investments worth almost one billion Danish kroner.

One third is invested in 17 global coal companies, which together own 132 coal-fired power plants, 12 operating coal mines and 9 new ones under construction.

This is revealed in an investigation of PensionDanmark’s latest equity and bond investments, carried out by Danwatch in collaboration with Finans.dk.

The investments are controversial. In addition to the annual CO2 emissions from coal power plants, which are many times higher than Denmark’s annual emissions, the investments also undermine PensionDanmark’s climate commitments to exclude coal mines and phase out coal power plants.

THE FACTS

The map shows coal mines and coal power plants that PensionDanmark is connected to via new equity and bond investments made in the period from October 2022 to November 2023.

In 2019, PensionDanmark was a co-founder of the UN investor alliance Net-Zero Asset Owner Alliance (NZAOA). Membership commits to investing towards the goal of carbon neutrality by 2050. According to the International Energy Agency (IEA), in addition to stopping new investments in coal, it requires the phasing out of existing coal-fired power plants by 2040.

“No further coal-fired power plants should be financed, insured, built, developed or planned,” the alliance writes in a position paper.

Danwatch has presented the investments to Therese Strand, Associate Professor of Corporate Governance and researcher in institutional investors at Copenhagen Business School. She now criticises PensionDanmark for greenwashing.

“PensionDanmark has promised its customers to support carbon neutrality by 2050, which means phasing out coal. They must deliver on this. In addition, they are a member of the Net-Zero Asset Owner Alliance, which under UN auspices obligates them in relation to other investors. In my opinion, it is high-level greenwashing to continue with new investments in energy companies that expand production from burning coal,” says Therese Strand.

PensionDanmark’s Head of Sustainability and ESG, Jan Kæraa Rasmussen, rejects the criticism. He does not believe that the new investments of over DKK 300 million in coal are problematic because the companies also make money on other things.

“I cannot see how this is greenwashing. When we calculate the coal share of revenue in the companies on the list (the list of new coal companies, Ed), our exposure is around DKK 100 million. We can vouch for that. I cannot take responsibility for more than what we have financed,” says Jan Kæraa Rasmussen.

Among PensionDanmark’s new investments is, for example, the Indian energy giant National Thermal Power Corporation (NTPC). According to data from Global Energy Monitor and Urgewald, NTPC is building new coal mines and increasing coal production from existing mines.

NTPC is therefore also one of the most excluded companies among Danish institutional investors, with Danske Bank and most recently Nykredit blacklisting the company.

NTPC states that they will keep their coal mines and power plants running beyond 2040 – partly due to the Indian government’s policy to increase the country’s coal production. The NTPC share has increased by 40 percent since the beginning of the year and has already been a good investment for PensionDanmark.

Nevertheless, PensionDanmark states that based on Danwatch’s investigation, they now exclude NTPC because the company is building new coal mines. The reason is that it is in direct conflict with the pension fund’s exclusion policy of “divesting from mining companies that start new thermal coal extraction”.

“In relation to NTPC, they supply power, including green power. We screen for new coal mines annually in December based on the IEA’s inventory, but based on your inquiry, we have already taken a closer look at NTPC and can see that they have applied for a new coal mine. Therefore, we are initiating an exclusion process, and NTPC is already out of our portfolio,” says Jan Kæraa Rasmussen.

Immediate divestment is one thing. Another question is why it only happens when Danwatch makes enquiries and why the investment was made in the first place?

“The exclusion decision is based on it being a new coal mine, and we did not have that information before or when we made the investment,” says Jan Kæraa Rasmussen.

With the upcoming exclusion of NTPC, five of a total of 21 new coal mines that can be linked to companies in the investment portfolio of PensionDanmark will disappear. Coal mine expansions continue to take place, among them the expansion of the Caval Ridge coal mine in Queensland Australia. The mine is owned by BHP and Mitsubishi Corporation, both of which are on PensionDanmark’s holding list.

If the parent companies of the mine owners are included, more can be added. For example, the expansion of the Carmichael Coal Project, also in Australia. The mine is owned by the Adani Group. PensionDanmark has invested in two Adani Group-controlled companies, Adani Ports & Special Economic Zone and Adani Electricity.

PensionDanmark has added many new coal power plants through new investments in one of China’s largest energy producers, China Resources Power Holdings, the Czech Republic’s largest company, CEZ, the US energy company Dominion Energy and many more.

They are additional to other coal investments, including Korea Electric Power Corporation (KEPCO), which co-owns a huge coal power plant in Suralaya in the Banten province of Indonesia. KEPCO is expanding the plant, but the expansion does not cause PensionDanmark to exclude the company.

“We have a green partnership with KEPCO and they are very aware that they are being criticised for their energy mix. We need to keep the dialogue with them, and KEPCO is not where they need to be. We are invested in CIP, which has signed agreements for the supply of green power from 900 MW offshore wind connected to KEPCO’s grid, and we can easily justify investing in the company, even though there is a clear potential for improvement,” says Jan Kæraa Rasmussen.

NTPC and KEPCO are far from the only coal companies in the investment portfolio. According to PensionDanmark’s own calculations, a total of DKK 905 million has been invested in coal companies.

More than half of the new coal companies on the investment list do not have a phase-out date for their coal power plants, which is a prerequisite for achieving carbon neutrality by 2050.

According to Jan Kæraa Rasmussen, phasing out coal must be understood in relation to the specific situation. The UN alliance’s recommendation for a phase-out by 2040 is not an ultimate requirement to fulfil, says Jan Kæraa Rasmussen.

“The recommendation to phase out coal is not open to interpretation, but how you work with the recommendations may differ. I can guarantee that we are continuously tightening our requirements in relation to what is realistic,” says Jan Kæraa Rasmussen in response to the criticism.

Several coal companies seem to be working with the same logic. For example, Japanese companies Sumitomo and Mitsubishi have adopted climate plans but are still involved in coal.

NZAOA is endorsed by the World Wide Fund for Nature (WWF), which both provides the logo for the communication and puts credibility at stake as an official strategic advisor and alliance partner. Secretary General of WWF in Denmark, Bo Øksnebjerg, demands an explanation from the pension fund after Danwatch has reviewed the investments with him.

“We want to make sure that the alliance members keep their agreements, which is why we have also contacted PensionDanmark to get an explanation of the investments. The world does not need new investments in coal, and our recommendation is not to invest in coal companies,” says Bo Øksnebjerg.

Bo Øksnebjerg also refers to the spirit of the alliance, which he believes PensionDanmark discredits.

“The agreement in the alliance is that coal companies will be phased out and these new investments do not support that. We are very disappointed. We do not believe that new coal investments are the way forward to fulfil the responsibility of reaching the goal of carbon neutrality. Nor do we believe that it reflects the spirit of the alliance’s rules of the game,” says Bo Øksnebjerg.

As we all know, the devil is in the detail. PensionDanmark’s CSR report states that coal should “as far as possible” be phased out by 2040. In the excruciatingly clear light of hindsight, this formulation looks like the perfect hedge against a change of mood in the financial markets. For example, when green investments are in decline and black investments are soaring, as is currently the case.

However, a change of CEO and a new dawn in the financial markets does not absolve a pension fund of responsibility, according to Therese Strand.

“Even if the financial markets turn and it becomes expensive to be climate-friendly, you cannot run away from your sustainability promises or green goals. Perhaps PensionDanmark has promised too much on the climate front, and now they cannot live up to it. The timing of the investments makes it clear that it is money and returns that speak. The principles were something they had as long as they could make money on it,” says Therese Strand.

In October 2023, PensionDanmark’s total fossil fuel investments in oil, gas and coal companies are estimated at DKK 4.7 billion.

See all of PensionDanmark’s investments in the Pension Machine.

THE FACTS

The map shows the coal power plants that can be connected to PensionDanmark’s investments. More than half of them do not have a phase-out plan.

According to the UN’s Net-Zero Asset Owner Alliance, existing coal power plants must be phased out by 2040 if the alliance’s climate goal of carbon neutrality is to be realised. PensionDanmark is a co-founder and member of the alliance.

Louise Lönborg is a mother. She has two young children, and like other parents, Louise is concerned about her children’s future. It has to be good, green and full of possibilities. That’s why Louise has set up child savings to ensure both children have some financial freedom when they turn 21.

She hopes that the children will use the savings both wisely and sensibly, based on their own wishes. Preferably in a world that by then has gone green and averted the worst climate disasters from global warming.

But Louise Lönborg’s bank, Nordea, invests part of her children’s savings in the world’s most CO2 emitting oil companies that continue to spend billions of dollars on developing new oil fields all over the world. These are new oil fields that will emit large amounts of CO2 in the future, contributing to further global warming.

This is according to a study conducted by Danwatch, which Politiken also mentions.

“It really provokes me. I wanted to invest the money and approved the investment fund, which had 6 out of 7 “stars” on sustainability. That’s why I’m pretty shocked that my bank is using my children’s savings to invest in big oil companies,” is Louise Lönborg’s reaction when Danwatch calls her to tell her about the investigation.

“After all, their huge CO2 emissions are the root cause of global warming. Of course I want my children to have good savings. But it’s pointless if I support an industry that will exacerbate the climate crisis well into my children’s future,” says Louise Lönborg.

THE FACTS

The lists below – broken down by bank – are not exhaustive, but are the result of an extensive search of known fossil fuel companies. If a company appears multiple times, it is because it is part of several different funds. This means that a bank can have, for example, four investments in the same company.

Nordea is far from the only bank investing children’s savings in black energy.

Danwatch’s investigation shows that also Danske Bank, Nykredit, Jyske Bank, Sydbank and Lokal Puljeinvest, an association of 42 local banks, invest money from children’s savings in large fossil fuel companies that plan to expand fossil fuel extraction.

According to their own figures, the banks in the study represent 9 out of 10 parents with children’s savings in terms of total market share. Louise Lönborg is thus far from being the only parent whose children’s savings are invested either directly or via funds in large expansive oil and coal companies.

Danish banks’ investments in coal, oil and gas companies that are working to expand production in the coming years are controversial because they de facto lead to higher CO2 emissions in the future. And CO2 emissions, as we know, are the main cause of global warming.

The warnings against investing in more coal mines and new oil and gas wells come from the International Energy Agency (IEA), among others. In a main report from 2021, the agency writes that all investment in new fossil fuel expansion should cease as of 2022 if the goal of a CO2-neutral society is to be achieved.

In an update from September this year, the IEA reiterates the message that investment in fossil fuel expansion is not compatible with the Paris Agreement. If the average global temperature is to rise by a maximum of 1.5 degrees, the IEA assesses that the fossil fuel industry will have to be phased out to a lower level.

“A few days ago I was talking to my children about what we can do to stop climate change. They are aware of this, for example by eating less meat and cycling instead of driving. But it is my responsibility as a parent to do what I can to ensure that their lives and the lives of future generations are not ruined by massive CO2 emissions. This applies to everything from what we eat for dinner to how we invest our children’s savings,” says Louise Lönborg.

Nordea’s Head of Investment Products, Kerstin Lysholm, explains that the bank is merely an advisor when it comes to investing children’s savings:

“We want to contribute to a more sustainable society, which is why we also inform and guide parents about their investment options and actively ask about their sustainability preferences. At the same time, we believe that it is the individual parents who can best make choices on behalf of their children, which is why it is ultimately up to the parents to decide how they want to invest,” says Kerstin Lysholm.

How does Nordea take into account that children’s savings belong to children who in the future will be harder hit by the climate crisis than their parents?

“Nordea assesses and considers children’s rights and the efforts to combat the climate crisis in its investments. This is done, among other things, through screening processes, ESG scoring, climate targets, analysis of companies’ transition plans and active engagement,” says Nordea.

Nordea does not wish to disclose its ESG ratings of the fossil fuel companies on the list. Nordea invests in oil giants Chevron, Devon, ExxonMobil and Occidental Petroleum, as well as China’s largest oil producer PetroChina and the Brazilian oil and gas company Petroleo Brasileiro.

“We are working to advance the ESG agenda. This also includes active co-ownership, where we invest in selected companies to drive sustainable change from within. In relation to these companies, we have a very effective dialog about reducing their emissions of methane, which is about 80 times as powerful a greenhouse gas as CO2,” says Kerstin Lysholm.

No posts

Danwatch has spoken to several other parents and reviewed their children’s savings to see how the money is invested. One of them is Henrik Ulander. He is the father of two children aged 11 and 15 and, like Louise Lönborg, is very surprised at how the family’s children’s savings in Nordea are invested.

Henrik Ulander’s agreement also includes investments in a number of large oil giants. Henrik Ulander is annoyed by the lack of transparency in the way the investments are presented to him when, at Danwatch’s request, he logs on to his online bank and finds the list of holdings.

“I can find the investment list. But it contains so many funds and mutual funds of which I cannot see the contents. It’s thought-provoking that oil companies are hidden in the funds. This makes it very difficult to figure out,” says Henrik Ulander.

Danwatch has shown Henrik Ulander the answer from Nordea that the bank is pushing for a sustainable transition through dialogues with fossil fuel companies. He’s not impressed.

“I find it very difficult to understand how a dialog with a company about methane gas promotes the green transition. I don’t think many parents can figure that out. It’s about children’s future, not about methane gas,” says Henrik Ulander.

THE FACTS

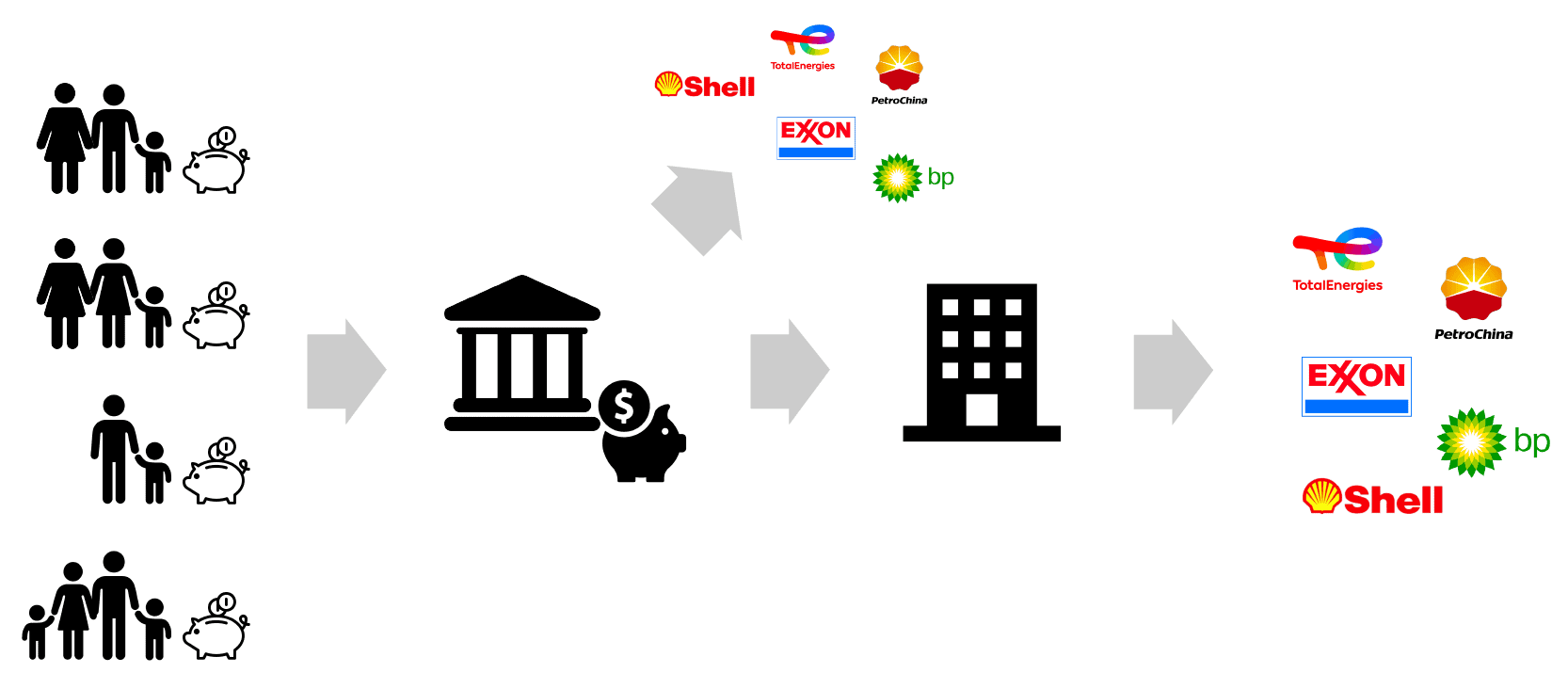

Most Danish banks make their children’s savings grow by buying shares and bonds issued by fossil fuel companies. Either the bank buys these shares and bonds itself, but more often the purchase is made indirectly through investments in so-called “funds”.

Danwatch’s investigation shows that equity investments in fossil fuel companies of all kinds are included in Danish banks. The banks invest in the largest and most well-known oil companies, including ExxonMobil, Chevron, Shell and many more.

These are oil companies, which according to the Financial Exclusions Tracker are among the world’s most unethical companies. The list shows the companies that have been publicly excluded by most financial institutions in the world. In other words, these are fossil fuel companies where responsible investors believe that the minimum criteria for averting the climate crisis and transitioning to green energy are not met.

ExxonMobil is also notorious for lying for decades about the impact of CO2 emissions from burning fossil fuels. Danwatch’s investigation shows that ExxonMobil is on the investment lists of Jyske Bank, Nordea, Sydbank and Lokal Puljeinvest. However, Lokal Puljeinvest removed ExxonMobil from the list two days after Danwatch contacted them.

Jens Theil, Head of Sustainability at Nykredit, which through its ownership of SparInvest manages the funds for Lokal Puljeinvest, informs that the divestment of ExxonMobil is due to a new policy for investing in fossil fuels, which also means divestment of Chevron and ConocoPhillips. However, there are still fossil fuel companies on the list.

“We have decided to keep 14 companies, including Shell and Inpex. They therefore remain the investment universe of the pools. These companies are not where they should be, but they are exempt because we still see an opportunity for them to change,” says Jens Theil.

Both children’s and pension savings typically have a long-term investment perspective, so the risk is spread across multiple sectors. The risk diversification means that the expected return can be realised with reasonable certainty in practice when, for example, the child turns 21.

However, in light of the climate crisis and the accompanying political objectives, more investors are being pressured to divest from fossil fuel companies. In Denmark, among others, AkademikerPension, AP Pension and Velliv have excluded a large number of fossil fuel companies because they oppose the green transition and continue to invest in new oil fields that will lead to increasing CO2 emissions far into the future.

According to Nikolaj Holdt Mikkelsen, a self-employed and independent investment expert with over 20 years of experience advising both private and professional clients, the fossil fuel sector is still important to many investors offering pooled schemes. But the fossil fuel sector is no longer essential to ensure a balanced risk/return ratio.

“As an investor, it’s nice to have as large an investment universe as possible to choose from. Fossil fuels have proven to be a good hedge in the inflationary environment in which we find ourselves. But you can still get a good spread even if you exclude the energy source. You can easily put together a portfolio without fossil fuels and have the same risk-return ratio as one with fossil fuels,” says Nikolaj Holdt Mikkelsen.

Danske Bank recognises that some of the funds in Puljeinvest are invested in fossil fuel companies via funds.

“It’s absolutely correct that with our children’s savings, you can choose to have Puljeinvest invest for you if you don’t have the time or ability to take care of the ongoing management yourself. This gives you a balanced investment solution in a very wide range of shares and bonds. You also have the option of opening a children’s savings account, where you can select and combine your investments yourself. You can, for example, choose funds with a sustainable focus,” Danske Bank’s press department tells Danwatch when asked how children’s savings and investments in fossil fuel companies are connected.

Louise Lönborg is pleased to hear this information. Although she, like most parents, doesn’t know much about investments, she now intends to approach her bank based on Danwatch’s investigation.

“I will ask the bank to remove the investments in black energy from the children’s savings, and I will find out if it is even possible to invest in green energy with the money I have saved for my children,” says Louise Lönborg.

Correction 18/10: A previous version of this article stated that Nykredit had implemented a new investment strategy. Instead, it’s a new policy for investing in fossil fuels.